This month of small losses was tough, but I finished up $1,680 overall. Thankfully, I could keep most of my losses relatively small due to the smaller size of my account and my desire to limit risk. As I got further into the month, I started using the Bjorgum Key Levels indicator within TradingView, which helped me quickly identify key levels.

What I Traded in February

I only traded $SPY and $QQQ options this month.

Though my account size is small, I utilized just about all available funds each day, which, for a couple of days, saved me. I recognize this is risky behavior because I encourage myself to get back in the market and sometimes make an incorrect play, erasing an earlier win I had that trading day.

I only trade for an hour at the most each day, but many of these days, I allowed the market to consume my mind even after I was done trading. After deciding I am done for the day, I need to do a better job of closing down TradingView so I can focus on other work.

Crypto

I have been watching crypto and noticed the market has been sideways for a long time and seems to be consolidating. I decided to add to my holdings on 2/20 and again on 2/24. At the time of writing this, 3/1, the crypto market has been moving to the upside, with some exciting things happening around popular meme coins. Perhaps we will finally see Bitcoin hit a new all-time high in March.

My Options Trading Journey

Last month, I decided to get back into stock options day trading. I had been trading off an on for the last several years, having some success followed by setbacks.

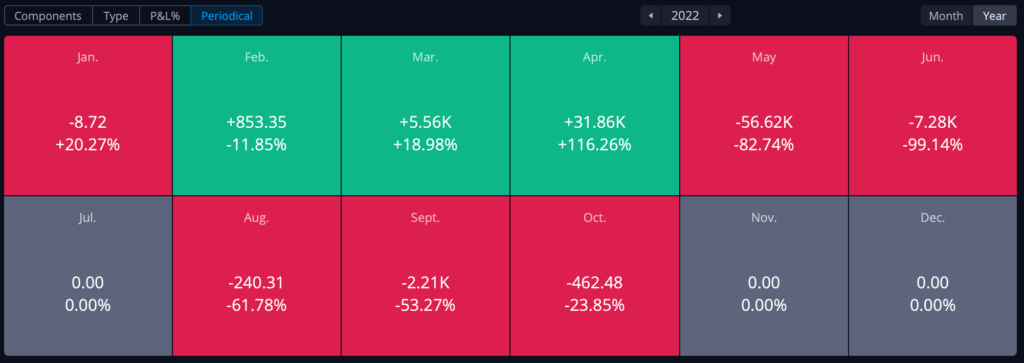

During the first half of 2022, I took my account from $12,000 to shy of $200k. That was followed by several colossal mistakes that destroyed my account. Those drops are not withdrawals; they are money returned to the market.

Those few months were pretty emotional. In June, I decided to stop trading because I could not control my emotions. Thankfully, I was only upside down a few thousand from where I had started.

During 2022, I would jump back in a few times, making additional mistakes and stepping away from trading again. This happened multiple times between August and October.

I continued to try throughout 2023. As you can see, I struggled even more, barely coming out on top for only a few months.

After all of this carnage, most would give up and hand their investing over to something managed or automated. Not me. This journey has taught me so much about the market and, more importantly, myself. Day Trading will expose your flaws and test your mental resolve. Your account value can grow really fast, and with that, certain character traits will surface. No self-help book or counseling can do that for you. You might never know about some of these character traits until you find yourself in a situation where they thrive.

Though I do have financial goals, Day Trading is more about what I can learn about myself. The past few years have taught me that self-discovery is my actual journey. The market tells you things about yourself nobody else could or would, and I love that.

What I’m Watching Out For In March

My goal in March is to avoid chasing trades that end up working against me. I tend to get into a trade late and follow it backward, hoping it’s just a short pullback. I also get greedy after exiting a good trade, which leads me to get back into the market prematurely, where I end up erasing some of my gains if not handing it all back.

I have some scripture that I have been reading often to help me keep greed in check.

- 1 John 2:16 – For everything in the world—the lust of the flesh, the lust of the eyes, and the pride of life—comes not from the Father but from the world.

I desire to keep my eyes on the Father and immediately give thanks for the opportunity to trade and for the results. The moment I focus too much on how much I made, greed sets in. I strive to replace greed with thankfulness. Both cannot exist at the same time. - Ecclesiastes 5:10 – Whoever loves money never has enough; whoever loves wealth is never satisfied with their income. This, too, is meaningless.

After a good trade, I can quickly think about the account growth and what I could do with that money. I must immediately turn to thankfulness and not focus on the monetary value itself because when I do, I end up getting back into other trades and making mistakes. - Hebrews 13:5 – Keep your lives free from the love of money and be content with what you have because God has said, “Never will I leave you; never will I forsake you.”

Avoid thinking about the value of the trade or my account throughout the day. After I’m done trading, I’m finished thinking about it.

The market also seems to be heating up a bit. There were more days of volatility than there have been now. I think March will bring more volatility, meaning more significant moves and opportunities. I am thankful for everything I have learned so far this year, as I feel better positioned to take advantage of volatility should it come.

I trade using Webull on my computer, smartphone, and table.

Fund your account with Webull and get a variety of free fractional stocks as well as zero commissions on trades.